ZAC Finance

One of the most popular use cases in DeFi today is lending and borrowing. Lenders are generally players who hold a significant amount of assets and are looking for ways to earn interest on their holdings that transcend normal market appreciation. By providing liquidity for an asset, long-term lenders are often rewarded when they use a specific lending platform. This comes as a win-win by adding liquidity to an asset’s market while giving passive income to those providing it.

Borrowers are seeking benefits that come with temporarily taking control of lenders’ resources, even if for a price. For one, by borrowing an asset, users can potentially short that commodity for profit on exchanges that do not support margin trading. Furthermore, these platforms can offer quick access to utility tokens that the borrower may not wish to hold, but simply wants to use for one specific task, such as participation in voting on a network. There are even “flash loans” available — a financial tool that enables users to request a loan, use the money borrowed and reimburse the loan atomically in a single transaction.

Decentralized exchanges have also gained popularity for their automated swap capabilities. The only “middleman” is a smart contract, which does not take a cut or slow down the exchange process. Funds remain in a user’s full custody, minimizing the security issues that have caused centralized exchanges to lose tens of millions of dollars in cryptocurrency due to hacks or mismanagement.

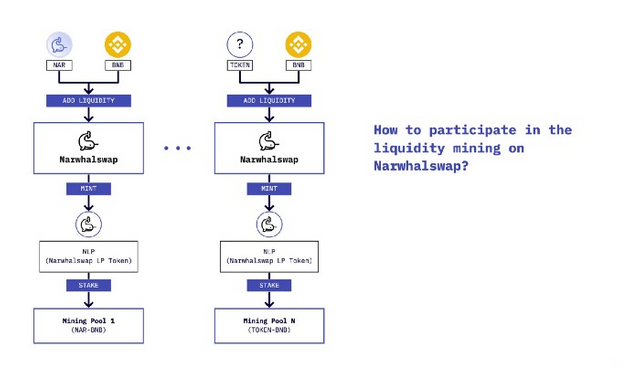

Liquidity pools are another emerging avenue of DeFi, and are often tied to decentralized exchanges. Some decentralized exchange, or DEX, platforms like Bancor Network and Uniswap encourage users to create and fund the liquidity pools needed to facilitate different exchange pairs. If you have a token and would like to exchange it with another, you can add liquidity for that token so others can swap and trade for it. This open process undermines the concept and process of getting listed on the traditional stock exchange.

In the case of decentralized finance, smart contracts are supposed to be its foundation layer as they are self-executing and do not require intermediary oversight. Ethereum introduced the concept of DeFi, which is why most of the DeFi applications are built on Ethereum blockchain.

The DeFi lending platforms offer crypto loans in a trustless manner and allow users to enlist the crypto coins they have in the DeFi lending platforms for lending purposes. With this decentralized platform, a borrower can directly take a loan, called DeFi P2P lending. Moreover, the lending protocol even allows the lender to earn interests.

Out of all the other DApps available, the DeFi is considered the most significant contributor for locking crypto assets whose lending growth rate is highest.

For those unfamiliar with DeFi lending, here’s a quick glance at what makes it unique:

- Ermissionless – Anyone can lend their assets across the protocol(s) of their choosing at minimal costs.

- Automated – Smart contracts follow pre-established parameters to issue, monitor and service active loans.

- Non-Custodial – Virtually all DeFi lending protocols do not require users to transfer ownership of their underlying assets. This means they can come and go as they please without any guidance or approval from a third party.

- Secure – Major lending protocols have been rigorously audited, meaning that funds supplied to lending contracts are backed by the most robust code in the world.

- Dynamic – Most major lending protocols today offer variable interest rates which are automatically adjusted relative to the supply and demand of any given asset.

- Stress-Free – Interest earned from lending is collected automatically, meaning there is little to no degree of maintenance required by end-users to earn a passive income on the most popular cryptocurrencies.

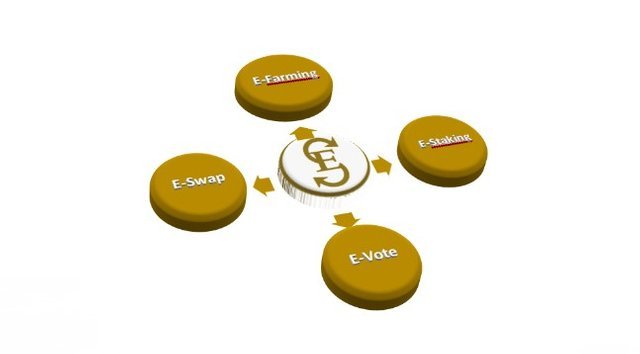

ZAC Finance it is an ecosystem Controlled by ZAC token.

- Z-Farm : You can here earn ZAC tokens by providing liquidity in a different pools.

- Z-Stake : Stake your ZAC token to get ZAC reward, ROI here will be different.

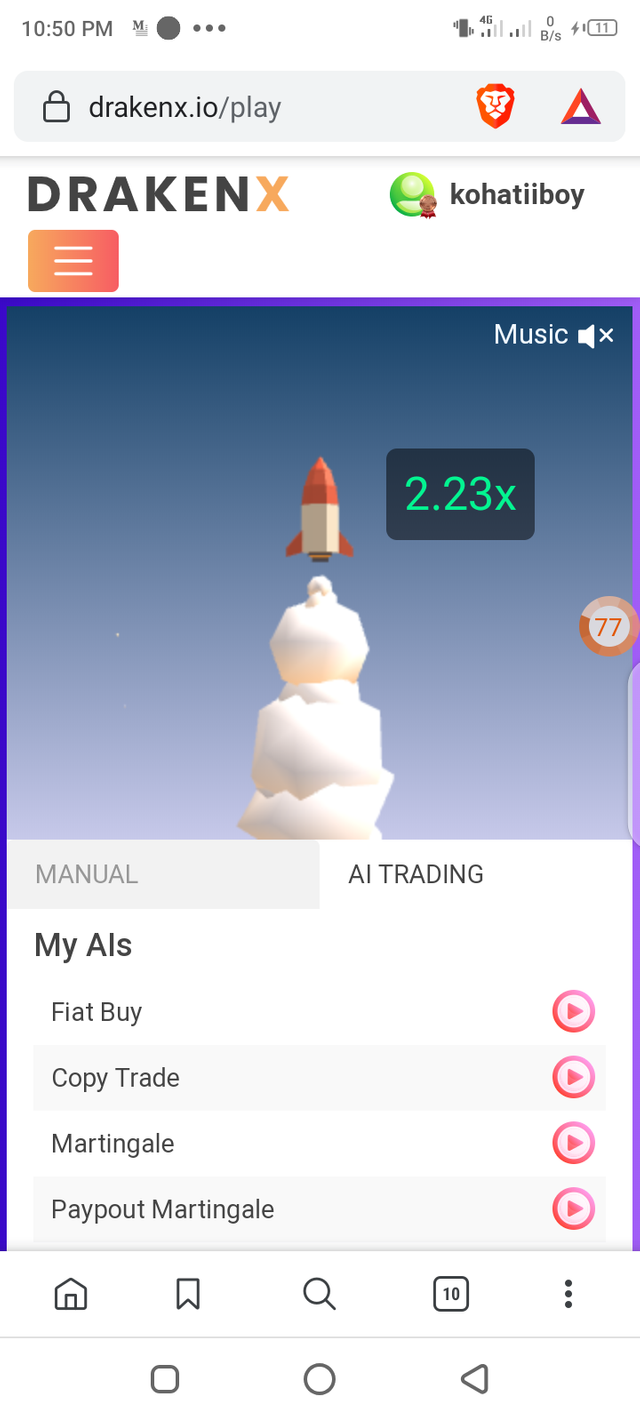

- Z-Trade : is a leveraged stablecoin exchange. It enables users to borrow stablecoins with up to 500x leverage.

- Z-Swap : Single sided automated market maker similar to uniswap.

- Z-Vault : Vaults employ strategies to automate the best yield farming opportunities available, they are designed so that the community could work together to build new strategies to find the best yield.

- Z-Vote : proposals from the forum will be on-chain to vote on from the users.

Z-Farm is a product from ZAC Finance that enables users to farm and earn zac tokens as rewards by adding liquidity to this pool. For every 7 days period of farming, the rewards will be added to fZAC ( farming contract ) and users will deposit UNI-V2 LP tokens to farm ZAC, who provide more liquidity he will get the biggest share from rewards.

In Z stake users can stake there own zac tokens to get a 5% reward monthly, they can unstake at any time and get the reward. Interest changeable mean the community will vote for change the % ( example from 5%to 3% or 7% ), but if we change the % and some users still stake there own zac they will not be affected by the new % they will keep get 5% each month until they unstake and stake again or stake new zac tokens. Minimum ZAC amount for the stake is 30 ZAC. The contract will be fully audited by an approved auditor from Callisto Network 100% secure and safe.

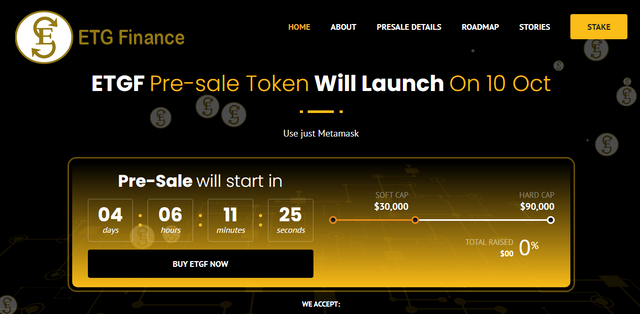

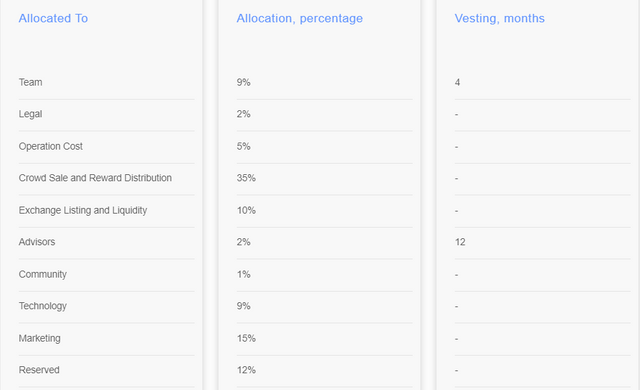

ZAC Tokenomics :

- Total Supply: 57000 ZAC

- Presale Tokens: 5130 ZAC 09% ( all tokens sold out )

- Uniswap Liquidity : 2565 ZAC 04.5% + 68.95 ETH

- Burned Tokens: 14235 ZAC 24.97%

- Future Development & Marketing : 5700 ZAC 10%

- Ecosystem Reward Tokens: 29370 ZAC 52.15%

- Z-Farm Contract: https://etherscan.io/address/0x5c11aa48bddf38433ff47bc5841d18721cc04d31#code

- Auditing Report: https://gist.github.com/MrCrambo/ab6768a2e83a41c9aa329f9ece102a9b

Conclusion

It is undeniable that DeFi continues to grow today and more people see the potential of Decentralized Finance as a solution for their financial ecosystem. Various Platforms continue to appear but there are still many bug, lack of development and most of them are scams. In my opinion, ZAC is one of the honest Platforms with good long term Scheme and variety of interesting features, making it an All-in-one Platform that is worth a try, I hope you become a part of this great platform, guys!

I think it’s enough for now, Don’t forget to for more content about the new potential Project, I will give some links related to ZAC Finance below. Thank you very much!

MEDIA INFORMATION:

- Website:https://zac.finance

- White Paper:https://zac.finance/whitepaper.pdf

- Email:support@zac.finance

- Twitter:https://twitter.com/FinanceZac

- Discord:https://discord.com/invite/ryBqXAm

- Telegram:@ZACFinanceP

- Ann Telegram Channel:@zacfinanceann

- Medium:https://medium.com/@zac.finance.token

Username : Ozie94

Profile : https://bitcointalk.org/index.php?action=profile;u=2103066

ETH : 0xDa2F65ea0ED1948576694e44b54637ebeCA22576